Is the racing industry self-sustainable in Australia?

RACING was once the fourth biggest industry in Australia, placing behind only the financial, healthcare and mining industries, but it’s now losing air like a flat tyre.

According to the 33rd Australian Gambling Statistics Report, government revenue taken from the racing industry has declined every year since the 2008-2009 financial year, despite the gaming and sports betting industries flourishing during that period.

In 2008/2009, the total revenue was $454.2 million in the racing industry, but there has been a steady decrease in those numbers ever since.

- 2015-2016 season returned only $182 million, which is an alarming drop in revenue.

- Total racing gambling spend by Australians for the 2015/2016 season increased from the previous year, despite that there was a loss of $33.8 million in government revenue.

Despite many “successful” Melbourne spring carnivals, government revenue in Victoria continues to spiral downward. It has haemorrhaged over $100 million in racing revenue from the 2007-2008 season to present day and the total gambling revenue has been saved only by the slight increases in gaming and sports betting.

Unlike many of the other states, Victorians are steadily decreasing their gambling expenditure in the racing industry. After reaching a peak of $809.1 million in 2006-2007, gambling expenditure in Victoria dropped to $494.1 million in 2015/2016.

New South Wales doesn’t quite make for similar reading. Its racing expenditure has increased from $933.4 million to $962.5 million over the last 10 years, but the government revenue during that time has seen a steady decrease.

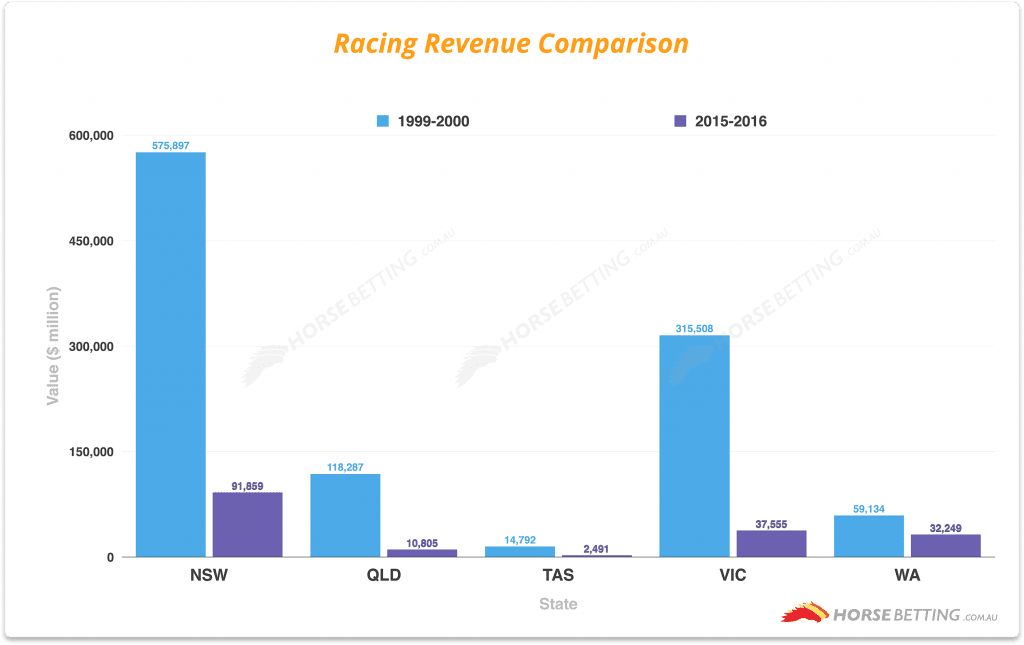

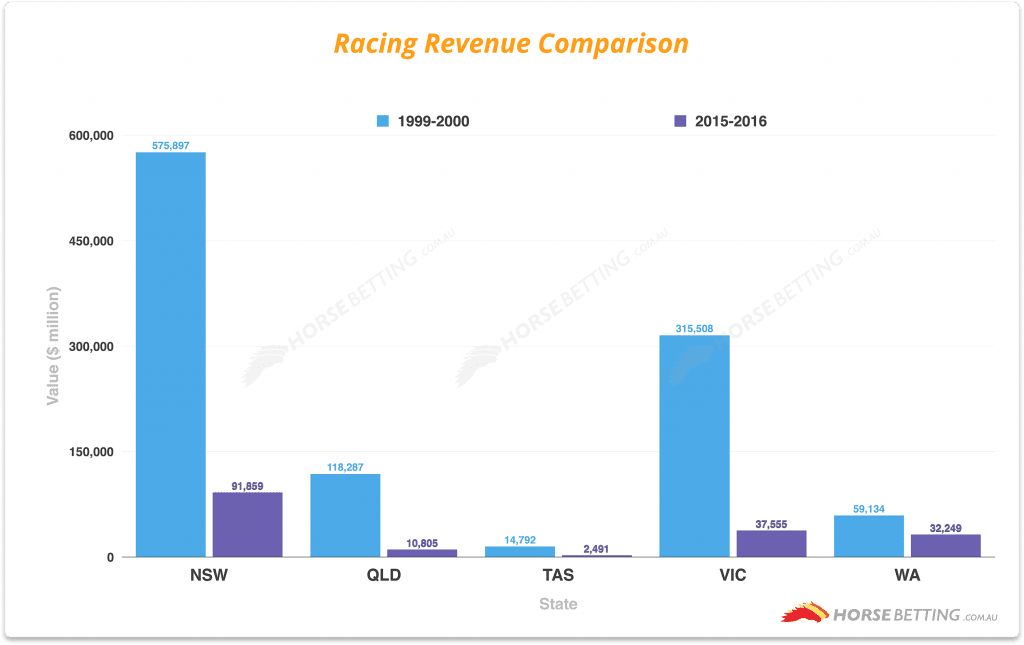

Currently at its lowest point, the NSW government is making just $91.9 million from racing, which isn’t a big number from one of the leading states in Australia, but there is an explanation for the significant drop off.

The NSW State Government of the Betting Tax Legislation Amendment Act 2015 reduced the NSW government’s share of revenue generated for punters’ bets on the NSW TAB and passed on that share to the three racing codes (thoroughbred, harness and greyhound) in NSW. Additionally bookmakers do now supplement the financial positions of the state racing codes directly via race fields fees and other revenue raising efforts which are somewhat distant from government.

Racing Queensland’s government revenue saw a dramatic drop from $38.9 million in 2013-2014 to $10.85 million in 2015/2016. The Racing Queensland board showed these significant losses in its annual report – stating a loss of $19.9 million in 2015/2016 compared to a loss of $11.2 million the season prior. The news is much better for the embattled state based on turnover figures, with total Queensland racing turnover down $48.1 million for the corresponding period. With the full effect of events like the Winter Carnival Eagle Farm track debacle yet to be accounted for, the prospects of an improved position for the 16/17 financial year would seem remote.

How corporate bookmakers have impacted the industry

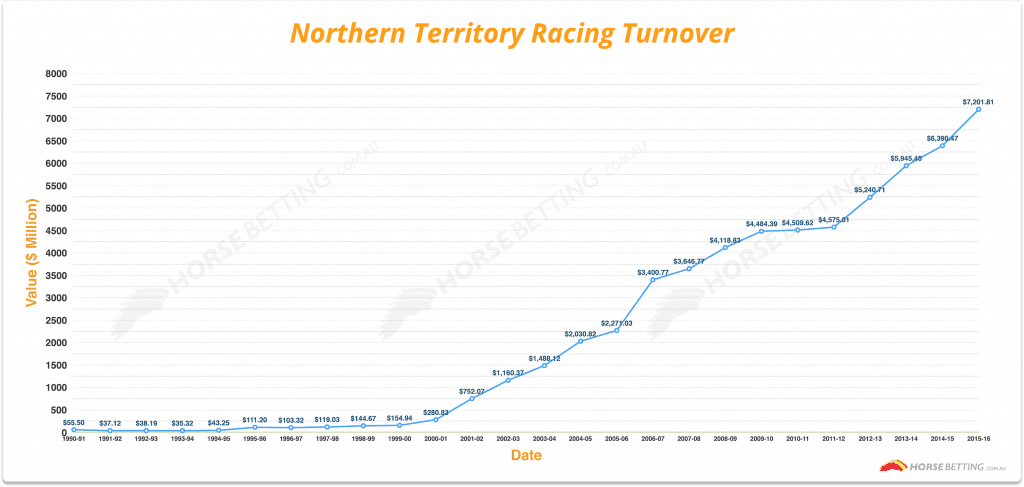

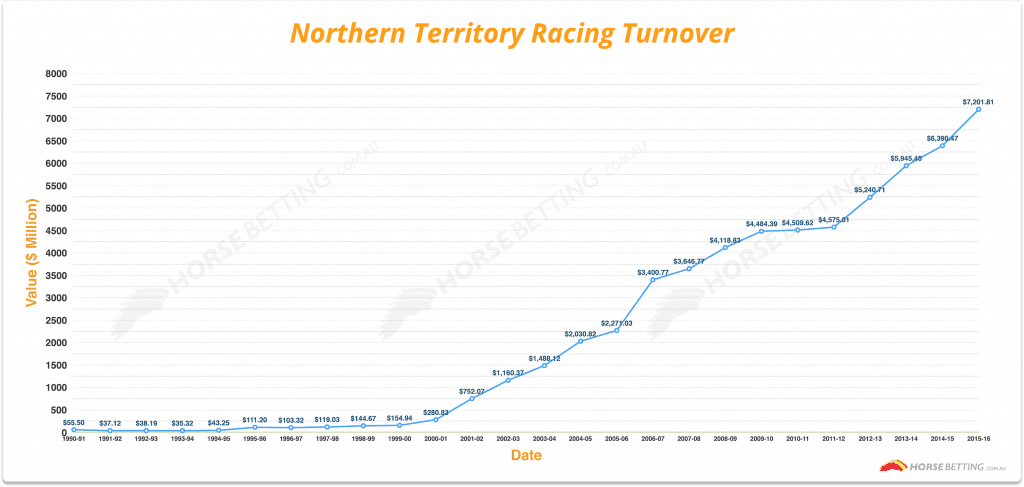

The Northern Territory Racing Commission granted licences to sport and racing bookmakers and betting exchange operators operating in the Northern Territory and the results have been incredible.

Trading at just $153.9 million in 1990, total racing turnover in 2015/2016 was at an incredible $7.3 billion and it’s all thanks to corporate bookmakers.

With a splurge of $823.8 million on the punt on all racing codes, NT ranks top of the class in Australia, but does that result in a positive for the territory government?

NT government revenue from the $7.3 billion turnover in the Northern Territory comes in at just $7.1 million. Bookmakers such as Sportsbet.com.au are located in the NT and although they do pay tax, GST and race field fees, the rates are much lower in the Northern Territory. The territory does however get other benefits in to the deal, with minimum levels of infrastructure and staffing required to be located in the “top end”.

The rise of the corporate bookmakers has increased the value of racing in the Northern Territory and the on-course totalisator turnover is a prime example. Once turning over $26.5 million, the NT now turns over only $8 million with the tote.

Compare that to the $177.9 million in Victoria and it’s clear to see that the impressive numbers from the Northern Territory all revolve around the impact of corporate bookmakers.

- Territorians plowed $13.3 million through the NT TAB boosting government coffers by $1.743 million – a rake of 7.6 percent.

- New South Wales clawed out 10% percent of what punters sent through the doors of the state TAB with the punt drunk state chipping $916.9 million to help the Tabcorp bottom line.

Can the government sustain racing without other gaming revenue?

It’s no surprise that many clubs, bars and even race tracks are wanting gaming machines installed at all costs.

Nationally the gaming industry, which is primarily supported by gaming machines, returned revenue of $5.8 billion in 2015/2016. With racing returning only $182.1 million, it’s clear to see which sector of the gambling industry is supporting the other.

With sports betting revenue also on the rise, we wouldn’t be surprised to see a parity between racing and sports betting in the near future. Betting on sports has become increasingly popular and it has bridged the gap between racing in recent years.

Where is racing losing ground? There was a surprising increase in on-course bookmaker turnover last season, but on-course totalisator numbers are dwindling.

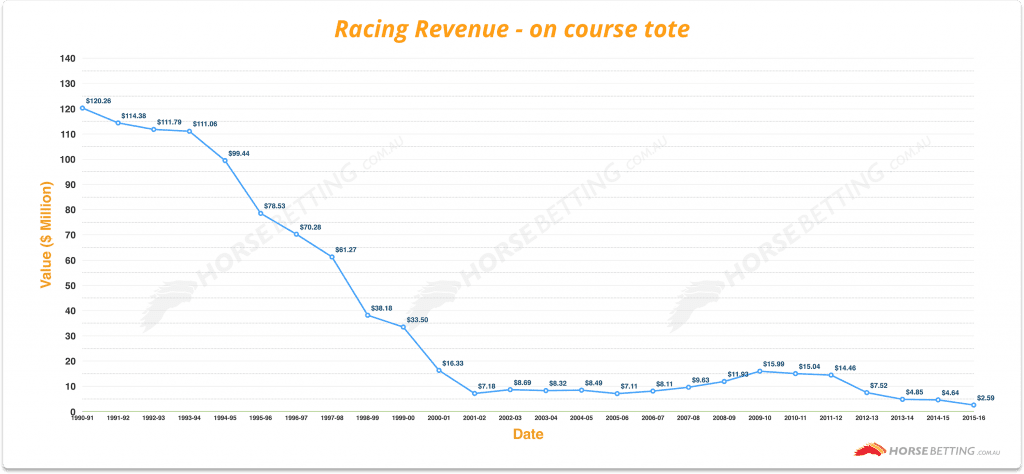

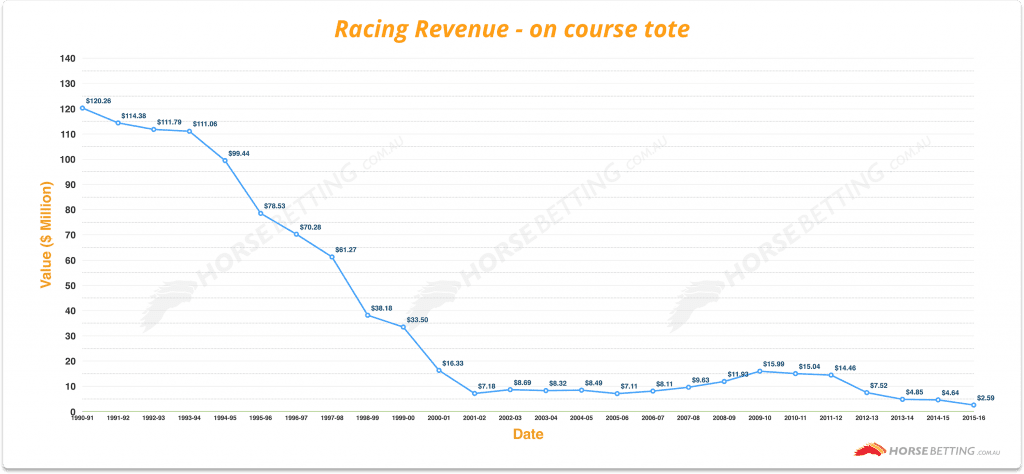

Technology has made it much easier to bet from home and even those that go to the races can bet on their phones or tablets. The popularity of on-course bookmakers was big during the 1990’s where it boosted government revenues nationally by $120.3 million off on-track turnover of $2.1 billion. Fast forward 25 years and by comparison the modern punter wouldn’t even know what a tote window looked like, with on-course tote turnover falling 87% to just 285.9 million.

Looking at the figures now is a sad state of affairs.

- Government revenue from on-course totes has dropped to just $2.6 million of the $182.1 total racing revenue.

- On course tote government revenue now sits at 1.2% of that generated in 1990/1991.

- On course tote government revenue now represents just 1.4% of total government racing revenues.

- On course tote turnover now represents just 1.6% of total racing turnover nationally.